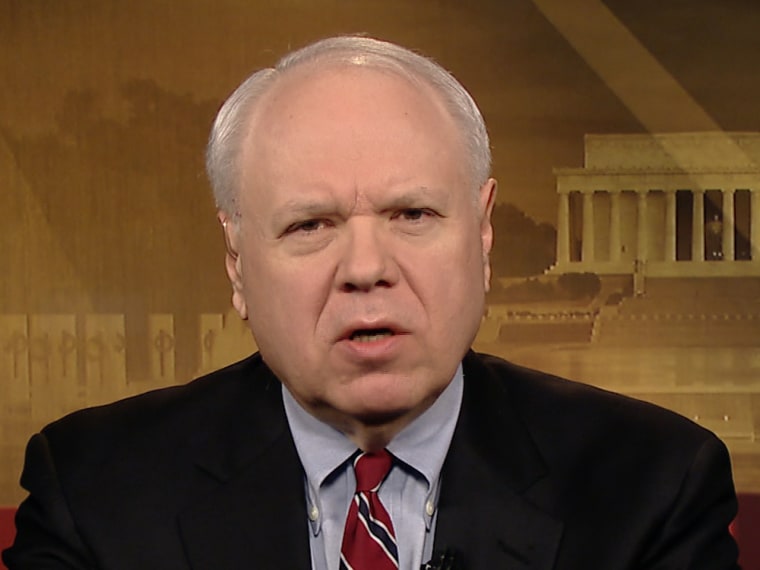

Bruce Bartlett, who served as a domestic policy adviser to President Ronald Reagan, argued for raising taxes as a way to reduce the debt Sunday on Up With Chris Hayes.

In a spirited debate with George Mason University fellow Veronique de Rugy about whether taxes can restrain future government spending, Bartlett rejected the claim that, without cutting spending significantly, the federal government creates deficits that lead to more taxes.

"But if you raise taxes first, then you wouldn't have the deficits," Bartlett said. "Your idea is so g--damn dogmatic that you're living in a fantasy world where we're going to balance the budget by abolishing Medicare and other ludicrous ideas."

Bartlett also had words for Grover Norquist and his no-tax acolytes, arguing that:

"One of the problems with the Norquist pledge is that, if you never raise taxes, there's never any cost to raising spending. So Veronique is essentially incorrect. She's assuming that taxes will rise to pay for spending, but Norquist will not allow that to happen. It used to be that the main constraint on increasing spending was the fear that it would lead to higher taxes. But if taxes never rise then you can have your cake and eat it too. We've reduced the tax cost of spending. Secondly, if you look at the CBO's long-term budget forecasts, one of the main drivers, in fact the main driver, of long-term spending is interest on the debt. So if we don't raise taxes, we're automatically causing an increase in spending. So we need higher revenues both to restrain spending and to change the dynamics of the fiscal process."

While de Rugy insisted that tax revenue alone couldn't pay for spending increases, Bartlett argued that returning to post-war tax rates of 18.5% would knock $500 billion a year off the deficit without additional budget cuts.