This article was co-authored by Emanuel and Andrew Steinmetz, who serves as Emanuel’s administrative coordinator and research assistant.

Republican lawmakers can shout and cry and pout and threaten a government shutdown all they want, but the Affordable Care Act’s new Health Insurance Exchanges (or Marketplaces) are coming online.

On Tuesday, millions of Americans who do not get coverage through their employers will be able to sign up for an affordable, understandable health insurance policy on websites that will look a lot like Amazon or Expedia. And when they log on, they are in for a pleasant surprise.

According to a report released last week by the Department of Health and Human Services, premium rates for 2014 will be 16% lower than expected in the 48 states that have released their data—and that’s before tax credits and subsidies are factored in. Affordable prices can be found from coast to coast. In New York, premiums in the individual market are set to fall by as much as 50%. In Texas, a 27-year-old man from Houston will be able to buy insurance for as little as $138 a month, and that’s if he earns too much to be eligible for a tax credit. If he earns $25,000, he could pay as little as $81 a month.

This is big news for a lot of people. There are roughly 15.4 million Americans who buy their insurance on their own. There are also roughly 20 million Americans who are currently uninsured but will not be covered by Medicaid, even after the program is expanded in 26 states in January.

Until now, these 35-plus million Americans have been getting a raw deal. Their health insurance (if they even have it) has cost them much, much more than their friends’ and neighbors’ who get coverage through their employers. Why can the new Health Insurance Marketplaces offer these great deals?

One reason is that insurance companies can more accurately predict, for example, the total health costs of 500 people than they can the total health costs of one person. And since these 35-plus million Americans have to purchase insurance entirely on their own, without the benefit of a large employer pool, they’ve had to fork over much higher premiums to cover this increased unpredictability.

The health insurance exchanges will begin to change all of that. This week, when self-insured individuals and families log on to their new exchange website, they’ll be joining a larger pool of people who also want insurance. They might not know it, but they’ll be aggregating their risk with others’, and consequently, they’ll be making it easier for insurance companies to offer them lower prices.

Another reason is in the word Marketplaces—with an emphasis on market. The exchanges come replete with all the economic forces that drive down costs in every other industry. They have standardized plans in 4 tiers that make comparison-shopping easy. There will be plenty of choice. Individuals in a federally run exchange will have an average of 53 plans to choose from. This induces competition among insurance companies. If they expect to win new customers, they’ll have to strive to offer lower priced packages than their competitors. Choice and competition will create downward pressure on premiums, and the 35-plus million Americans who buy insurance on their own will pay much less as a result.

It is still puzzling how conservative Republicans who champion the free market can be so viciously opposed to this idea.

Over the long term, this downward price pressure bodes well for everyone—even people who currently get insurance through their employers. If premiums keep falling and the user experience is good, over time, buying insurance on the exchange might end up being a better deal than employer-based care. Or at the very least, employer-based plans will feel pressure to keep pace with plans on the exchanges.

Unfortunately, there is one potential hitch in all this progress. There are several states that are doing their best to make sure the exchanges don’t succeed. And in a cruel twist of irony, the states that are resisting the exchanges are actually the states that need them most.

The diabetes death rate in states that have refused to set up their own exchanges is 7% higher than the national average. And take a look at this map of female mortality rates. Notice anything? These are the very red states that are opting out of Medicaid and not running their own exchanges.

Via: The Advisory Board Company

The governors, state legislatures, and federal representatives in roughly half the states have committed themselves to gumming up the Affordable Care Act in any way possible. That means when you call your congressman’s office to ask how sign up for insurance, instead of saying “just go to healthcare.gov,” the person on the other end will shrug and wish you good luck.

They are also discouraging enrollment among younger individuals, hoping to prey on a concept called adverse selection. If the population in the exchange is disproportionately old and disproportionately sick, insurance companies will still be able to charge very high prices for coverage because there would be a much higher likelihood they’d be stuck with high cost medical bills. Even though the risk would still be pooled and predictable, the risk would be too high. The presence of young and healthy people in the pool will allow risk to be spread and costs to go down for everyone.

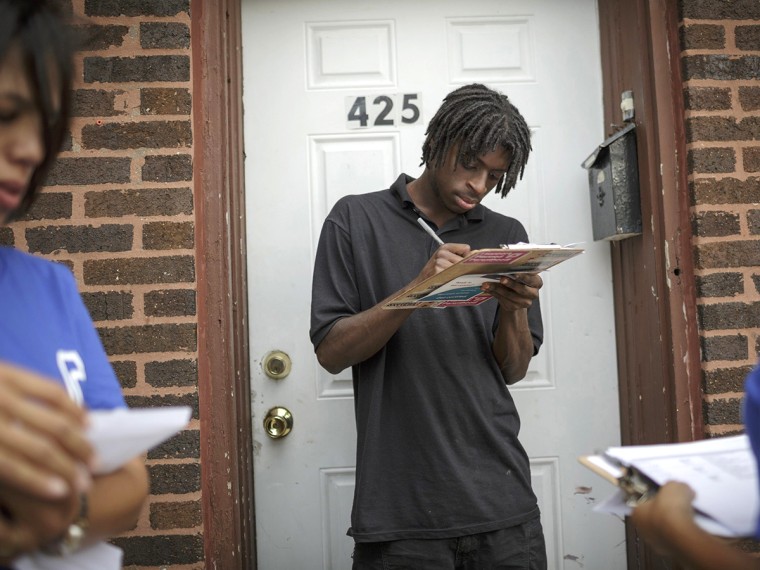

Of course, young people have every reason to sign up. Buying insurance will be quick, easy, and accessible. They’ll be able to purchase it online, just like they purchase everything else. And many of them will be eligible for considerable subsidies. Of males aged 18 to 34 in the individual market today, for example, 60% will be eligible for Medicaid or a tax credit to help pay their insurance premiums. In Philadelphia, a bronze plan for a 27-year-old with an income of $25,000 will cost as little as $94 a month.

No matter how you slice it, the opening of the health insurance exchanges is a major milestone in American health care. We are at a pivot point. With these marketplaces providing choice and competition to individuals we will finally begin to lower insurance costs while also helping more people protect themselves from the financial burden of getting sick.

Check out healthcare.gov to find out more information about the exchange in your state. And make sure to tell everyone you know: your health exchange is coming to town.